Ceasefire, not peace

I wrote about the coming Trump and Xi meeting in South Korea a week ago and predicted the meeting, while likely outwardly friendly, will be a nothing burger in substance and long-term impact.

They met a few days ago and the result is very much as expected. Progress was made, mainly in transactional areas such as soybean purchase and fentanyl, but core differences were either kept off the agenda (Taiwan) or kicked down the road (rare earth and trade embargo).

Both leaders were very cordial and diplomatic. There were smiles and handshakes both before and after the 100-minute meeting. Trump walked Xi to his car after the meet, and he was invited to Beijing next April.

Xi didn’t offer Trump gold golf balls or pre-owned putter belonging to a dead lackey. The new Japanese prime minister did that, with unrestrained fawning that can only be described as slavish and more than a bit sickening, reminding one of what Trump said about “some foreign leaders lining up to kiss my ass…please sir please”.

But the photo-op with Xi seemed to please Trump mightily, who rated the meeting “12 out of 10” to the press on the flight home, true to reality TV star.

So what was accomplished from the Busan meeting? Where are we now in the trade and tech war? In a nutshell, it was meaningful enough to stabilize the fraught relationship temporarily but the big picture hasn’t changed. We have an uneasy ceasefire at best, not a peace deal.

Beijing held true to the spirit that it expressed from the outset of the trade war: “our doors are open, if the US wants to talk; but we’ll fight till the end, if you want a fight”.

Even before the meeting, Trump wisely off-ramped himself from the initial 100% tariff threat so he left Busan without being called TACO again. Markets reacted well.

Essentially, we are back to where things stand in the Madrid round of negotiations in September.

Let’s unpack the deal and hypothesize where things will go in the next 6 to 12 months.

According to the official Chinese readout, generally far more credible and less sensational than western media reports, the core elements of the agreement include –

– A reprieve of the new rare earth rules announced by Beijing in October for one year, in exchange for the US suspending the “BIS 50%” rule for Entity List (euphemism for trade blacklist) for one year.

The 50% rule, announced by the Bureau of Industry and Security of the US Department of Commerce, was what triggered the Chinese rare earth retaliation in the first place.

According to the rule, any company outside of China more than 50% owned by a Chinese company on the Entity List is subject to the same sanctions as the parent company. If Company A owns 50% of Company B and Company B owns 50% of Company C, then companies A, B, and C are all subject to the same sanctions.

The rule expanded Chinese companies on the Entity List by 10 times, affecting some 25,000 businesses based outside of China.

– Both governments will suspend the port fees on each other’s shipping fleet by one year. The port fee was first imposed by the US on Chinese-built, owned, and operated ships docking on US ports. China retaliated with reciprocal fees on US ships docking in Chinese ports.

– The US will reduce the so-called fentanyl tax to 10%. In exchange, China will purchase some unspecified quantity of US soybean.

– Both sides will continue to finalize the TikTok sales.

What was conspicuously missing in the “deal” was any mention of Taiwan and semiconductors. Taiwan didn’t rate a mention by either side, indicating Beijing and Washington prefer to decouple geopolitics from the trade negotiations.

The absence of semiconductors in the discussion clearly shows Beijing is confident of its ability to develop the technology independently and will focus on self-sufficiency.

Beijing does not consider rare earth as a bargaining chip to get access to US chips. Without the complication, it can turn on rare earth restrictions whenever needed.

The core deliverable from the meeting is the mutual suspension, by one year, of the rare earth restrictions and Entity List expansion. Everything else can be considered sundry items.

China’s concession to purchase soybean from the US aligns with its strategy not to rely on any single supplier as its import of soybean is getting too heavily concentrated from Brazil at the moment.

Brazil is taking advantage of that dependency by overcharging its soybeans with what is called the “Brazil premium” which Beijing wants to neutralize with purchases from Argentina and the US.

As China finds new use for soybean beyond animal feed, e.g. to process for biofuel, additional purchases are aligned with its own national interests.

Now that a temporary truce is declared, the two sides will codify the terms into a trade agreement. If Trump does travel to Beijing in April, a formal deal could be announced then.

We can attempt some educated guesses on what will happen next –

– Both the US and China are likely to use the one year reprieve to ready itself for the next round of trade frictions: the US will attempt to build an alternative rare earth supply chain, with its allies and independent of China; China will finetune the enforcement methods of its new extra-territorial rare earth control policies so it can operationalize them effectively when necessary – after all, this is a new muscle to be flexed;

– Beijing is likely to block US chip sales to the Chinese market, especially the AI chips from Nvidia and AMD. This is to incentivize and turbocharge domestic substitutes and rid any dependencies on US tech;

– Beijing may make an example of US allies aligning too closely with Washington at China’s expense. For example, the recent Dutch theft of Nexperia from its Chinese owners is likely to be dealt with bare knuckles.

The lackeys don’t rate the same courtesy as the dog owner and Europe is a soft target. Vassals will pay the price of vassalhood. Maybe Mark Rutte, the former Dutch prime minister, can go to his “daddy” to sob about the unfairness.

Some hold the view the US China tension will deescalate after the meeting. I don’t subscribe to that view.

An analogy can be found when there was optimism of a China India reconciliation a few months ago, after India got slapped with 50% tariff by the US. Modi went to Tianjin to attend SCO meeting. There was photo-op with Xi, Putin and Modi in the same frame.

Unsurprisingly, Modi was just opportunistically displaying displeasure at the US without real intention to build a collaborative relationship with China. He was trying to get some brownie points to negotiate with the US, which can easily lure India back with some token gestures.

That seems to be exactly what happened – India has agreed to stop buying Russian oil to get back to the good grace of its master.

Beijing is cool headed with its structural rivalry with the US. Xi was not interested in a checkmate through rare earth with Trump for now. Instead, he is pursuing a managed competition for the long run.

Beijing is building the infrastructure to reduce dependency – e.g. it forced BHP to accept RMB payment for iron ore in a drive to further de-dollarize commodity trade; it is diversifying agricultural and energy purchases and redirecting trade to emerging markets, especially those in the Belt and Road Initiative.

The next step of China’s decoupling from the US will be less painful: Beijing is shifting its export focus to high value goods such as such as EV, lithium ion batteries, photovoltaics, and integrated circuits.

Such exports are minimally dependent on the US market – only 1-2% of exports in those categories are destined for the US today. So any further trade cutback won’t affect China much. What the US buys from China today is what it cannot buy elsewhere economically.

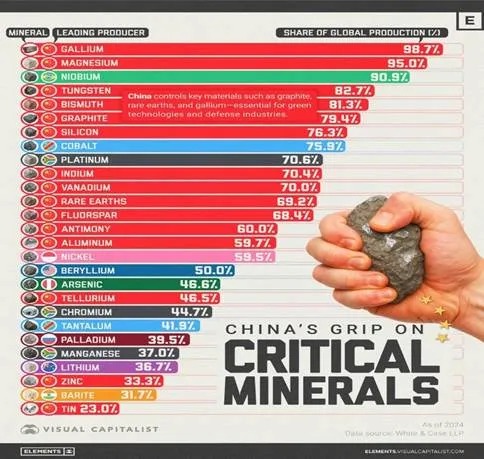

Furthermore, China has lots of arrows in the quiver in any future tit-for-tat with the US. China enjoys dominant position in key starting materials (KSMs) and active pharmaceutical ingredients (APIs) that US big pharma relies upon. China also has dominant position in a variety of other critical minerals needed for high tech production and green transition.

For now, Xi opted for stability and truce rather than a complete decoupling. This reflects Chinese strategic thinking – competition among nations is a game of GO (wei qi or the “surrounding game”) rather than a game of chess.

GO and chess are both two-player, perfect-information, zero-sum board games, but after that almost every assumption diverges. One game is about killing the king. The other about land-grab: fence off more territory.

In the game of GO, the objective is to surround and claim more territory than your opponent, rather than to checkmate the opponent’s king in chess.

Chess is about one single, decisive move to success. GO is more of a strategic, territorial war that requires long-term thinking and balancing competing interests.

Go is also vastly more complex than chess with 10¹⁷⁰ game-tree positions (more legal positions than atoms in the observable universe).

Ultimately the game of Go is strategic: whole-board judgment, long-term trade-offs, and “lose the battle to win the war.”

Xi is playing the long game of Go with Trump’s open-and-shut chess moves. His message is subtle – to let the US know China has the capacity to play hard ball without actually having to play hard ball. For now.

We’ll see whether Washington gets it or not.

Source: https://huabinoliver.substack.com/p/where-are-we-now-in-the-trade-and-c39