In the 21st century, global power competition is being reshaped along the axes of energy, technology, and critical minerals. Rare Earth Elements (REE), which lie at the center of this transformation, have become essential inputs for modern economies, military technologies, and high-tech industries. Therefore, REE supply chains are no longer just an economic matter; they have turned into a field of global competition with geopolitical, strategic, and security dimensions. In this process, rare earth elements have gained critical strategic value in both economic and military fields, placing them at the heart of the competition especially between China and the United States. China’s dominant control over the production and processing capacity of rare earth elements has created global supply dependence and triggered geo-economic tensions between the two powers. However the REE competition is not merely a bilateral struggle between China and the U.S. Russia, India, Australia, African countries, Latin America, and Southeast Asia have also become part of this competition with their critical mineral reserves and strategic policies. Thus, the struggle over REE has taken on a multipolar character, giving rise to a new balance of power in international relations.

The Strategic Importance of Rare Earth Elements

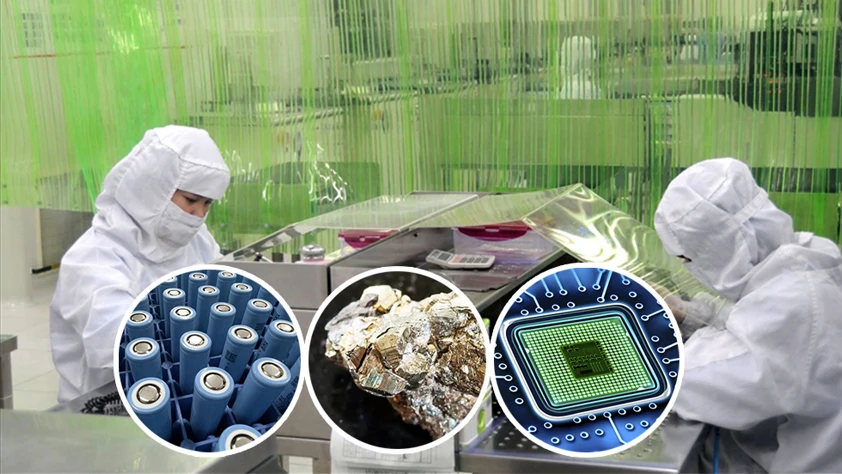

Rare earth elements are indispensable components used in nearly all advanced modern technologies. From the defense industry to artificial intelligence hardware, and from electric vehicles to semiconductors, many critical products cannot be manufactured without these elements. They have a wide range of applications from electric vehicle motors to radar systems, from high-power magnets to defense industry products. For example, the fact that an F-35 fighter jet contains more than 400 kg of rare earth elements illustrates the scale of this dependency. Laser systems, guidance mechanisms, and radar technologies cannot be produced without REE. This makes rare earth elements critical for military capability and strategic deterrence.

Elements such as neodymium, praseodymium, and dysprosium play a crucial role in the production of high-performance magnetic materials. They have become indispensable components of products such as wind turbines, smartphones, and electric vehicles. Therefore, the energy and technology systems of the future depend on the security of REE supply chains.

The Ukraine War and Rare Earth Elements

Ukraine is one of Europe’s most critical potential supply points, especially regarding lithium, titanium, zirconium, and several light REE reserves. Before the war, Ukraine was regarded as “Europe’s future critical minerals hub.” This made the country not only a military but also a geo-economic arena of competition. Russia aimed to secure strategic advantage in aerospace and defense industries by taking control of significant titanium and zirconium resources in the regions it occupied in Ukraine. Moscow views Ukraine’s reserves as geopolitical leverage to reduce its dependence on China in the global critical minerals market. The U.S., on the other hand, considers Ukraine’s REE and critical mineral potential as a means to diversify supply chains against China and Russia.

The prolongation of the war is pushing the U.S. and Europe to increase defense production, which in turn raises global REE demand even further. Since the defense industry heavily uses REE for lasers, radars, and missile guidance systems, dominant producing country in this field China becomes the indirect beneficiary of the war’s geo-economic repercussions. REE and critical minerals have become strategic priorities in the Ukraine war. Due to energy transition, defense production, and semiconductor competition, the power struggle among the U.S., Russia, and China has evolved into an era of “resource wars.” Control of Ukraine is vital for Europe’s goal of reducing its dependence on China. The Ukraine war has moved beyond a classic geopolitical conflict and has become central to the U.S.–Russia–China rivalry across critical minerals, REE, energy transition, and defense industry production.

China’s Dominance over Rare Earth Elements and Global Competition

China accounts for 60–70% of global production and controls more than 80% of the processing capacity. This gives Beijing significant economic and geopolitical leverage. China’s low-cost production policies in the 2000s led to the closure of mining facilities in countries such as the United States and Japan. This process increased China’s control over the global market. With its production capacity and the supply-chain ecosystem it has established, China has effectively become a monopoly and also uses REE as a geopolitical pressure tool. China’s imposition of REE export restrictions on Japan in 2010 demonstrated that these resources can be used as instruments of foreign policy. As competition with the U.S. intensifies, the likelihood of similar actions being repeated is high. The U.S., aiming to reduce its dependence on China, has adopted a strategy of increasing domestic production, cooperating with allies, and investing in alternative technologies.

The reactivation of the Mountain Pass mine in California is a result of this effort, but the U.S. still remains dependent on China for processing technology. The U.S. is trying to build an alternative global REE supply chain by signing new supply agreements with Australia, Canada, and African countries. Washington has accelerated research on recycling and substitute materials and invested in R&D to develop alternative magnets in order to reduce dependence on rare earth elements.

Table 1: REE Reserves by Country

| Country | Estimated Reserves (Million Tons REO) |

| China | 44 |

| Brazil | 21 |

| India | 6.9 |

| Australia | 5.7 |

| Russia | 3.8 |

| Vietnam | 3.5 |

| USA | 1.9 |

| Gronland | 1.5 |

Figure 1: Distribution of REE Reserves

Russia has large REE reserves (Siberia, Yakutia, Murmansk region). After Western sanctions following the Ukraine war, Russia has sought to build alternative power through critical minerals. Russia is increasing cooperation with China and India on critical minerals, creating a non-Western REE bloc. Russian military technology, especially electronic warfare systems, is dependent on REE. Russia advocates conducting international REE trade within a non-dollar system under BRICS. If this materializes, it could create an economic power similar to the petrodollar system, placing the most strategic resources of the future, REE at the center of the new economic order.

India’s Rising Geostrategic Role as a Potential Alternative

India is an emerging actor in global competition in terms of REE reserves and processing capacity. The country possesses significant REE reserves, especially in monazite sands. India is forming REE partnerships with the U.S., Australia, and Japan under the QUAD framework to balance China. With its geopolitical stability, demographic capacity, and strategic position in the Indian Ocean, India stands out as a potential non-Chinese production hub.

Figure 2: Global REE Production Shares

Table 2: Strategic Position of Countries in REE

| Country | Production share (%) | Geopolitical Strategy |

| China | 70 | Protecting the global processing monopoly |

| USA | 10 | Reducing dependency, building alliance chains. |

| Russia | 10 | Using the source card as a diplomatic tool |

| India | 5 | Emerging producer, becoming an alternative to China |

Africa and South America: New Geo-economic Frontiers

The unseen front of the REE war is Africa and Latin America. Tanzania, Madagascar, and the Democratic Republic of Congo hold some of the world’s most important critical mineral reserves. China is investing heavily in these regions, while the U.S. and EU are rapidly expanding their presence. Brazil and Bolivia hold critical positions in terms of lithium and rare earth elements. The region has become the center of a new “mineral diplomacy.”

Türkiye’s Rare Earth Elements Potential

A significant rare earth element (REE) reserve has been identified in the Eskişehir–Beylikova region of Türkiye. Although Türkiye’s potential is high, coordinated and comprehensive work is required for the country to become a major producer in this field. To determine production capacity and international market impact, it is important to accurately establish the data on the extractable oxide content of the reserve. While some media sources mention very high potential, scientific analyses take a more cautious approach at present. Advanced drilling, processing, and analytical studies are critical for determining the technical extractability of REE. Research in the regions identified as having potential in Türkiye is continuing intensively. All these developments indicate that Türkiye could become a major actor in the REE market.

The recent expansion in Türkiye’s defense industry, energy transition, and R&D ecosystem constitutes the key dynamics that increase the country’s competitiveness in this field. Rare earth elements are indispensable for critical production areas such as defense technologies, radar systems, guidance mechanisms, armor composites, and high-temperature superalloys. Türkiye’s defense industry, energy transformation, and R&D ecosystem’s capacity increases in recent years are key dynamics that enhance its competitiveness in this field. Therefore, nationalizing the REE supply chain is of strategic importance for making Türkiye’s domestic defense industry sustainable. In the energy and transportation sectors, REE-based magnets used in electric vehicle motors, wind turbines, and battery technologies play a critical role in Türkiye’s green transition goals. Since global REE demand is expected to triple in the next decade, Türkiye’s early positioning in the supply chain will provide a competitive advantage.

However, the main risk Türkiye faces is dependence on foreign refinement and alloy technologies. These technologies are dominated by China, Japan, and France. For Türkiye to move up to the higher levels of the value chain, it must develop a strong domestic R&D infrastructure, technology transfer mechanisms, and environmentally responsible mining models. Europe’s search for geographically closer suppliers offers Türkiye significant logistical and commercial advantages. The Customs Union status makes Türkiye a natural regional supply hub. Realizing this potential requires a comprehensive REE strategy and a flexible financing model supported by public–private partnerships. If Türkiye strengthens the right technological investments, refining capacity, and R&D ecosystem, it can become not only a raw material supplier but also a strategic power center with geopolitical and economic influence in the global REE market.

The Impact of Multipolar REE Competition on Systemic Paradigm Shift

Rare earth elements have become the most strategic raw materials of the 21st century and have taken center stage in the multipolar global power struggle. While the China–U.S. rivalry forms the main axis of this domain, Russia, India, Africa, and Latin America have also become critical actors in the game. Therefore, the REE struggle is now a long-term power race shaped by geo-economic pressure tools, supply chain wars, technology embargoes, and shifts in global alliances. Although the possibility of the rare earth elements competition turning into a hot war is theoretically possible, in practice it is considered low. Globally, the short-term probability of a hot war is low; however, it is clear that a geo-economic cold war centered on REE has begun. This competition will be one of the fundamental factors shaping the future energy transition, military balances, and the global technological order. China depends on exporting to the U.S. market; the U.S., in turn, depends on China’s production capacity. This mutual dependency raises the cost of war. A hot war, in terms of cost-benefit analysis, could bring about the collapse of the global economy. In the short term, such an outcome is against the interests of both actors. Economic interdependence, cost-benefit balance, and global market stability limit this possibility. The real competition is progressing not as a hot war, but as geo-economic and technological bloc formation.

Although the China–U.S. rivalry lies at the center of the REE competition, the rise of other actors has created a multipolar structure. Africa, Central Asia, and the Indo-Pacific are regions where proxy competition through REE may emerge. The REE race also signals a new global divide between economic blocs. Technological, ideological, and sociological paradigm shifts will create a new eco-political order on a global scale.

When eco-political data are analyzed, it is assessed that the world is on the verge of a major depression-like transformation similar to the 1929 global economic crisis. This crisis is not solely finance-centered; it could occur in multiple domains simultaneously; the potential for a hybrid mega-crisis between 2029–2035 encompassing financial collapse, energy and food crises, geopolitical conflict over rare earth elements, a digital economy crash, supply chain disruptions, and the fragmentation of a bloc-dominated world economy, could lead to the practical, global implementation of the great reset theory.

In a context where nation-states are heavily indebted and global income inequality has reached alarming levels, it becomes clear that the final stage of the capitalism-based economic system is approaching. Trump, who has tragically and comically described himself as the captain of a sinking ship as the U.S. enters its 250th year, is accelerating this collapse rather than stopping it through his policies. The “globalism” system, a new format resembling a blend of socialist and capitalist values, heavily promoted alongside the COVID-19 pandemic as an enhanced version of colonialism, is being systematically marketed as humanity’s new prescription for salvation, intended to replace the current order.

*Enes Güneyli: President, Center for International Education, Technology and R&D – METAM